20 Jan 2024

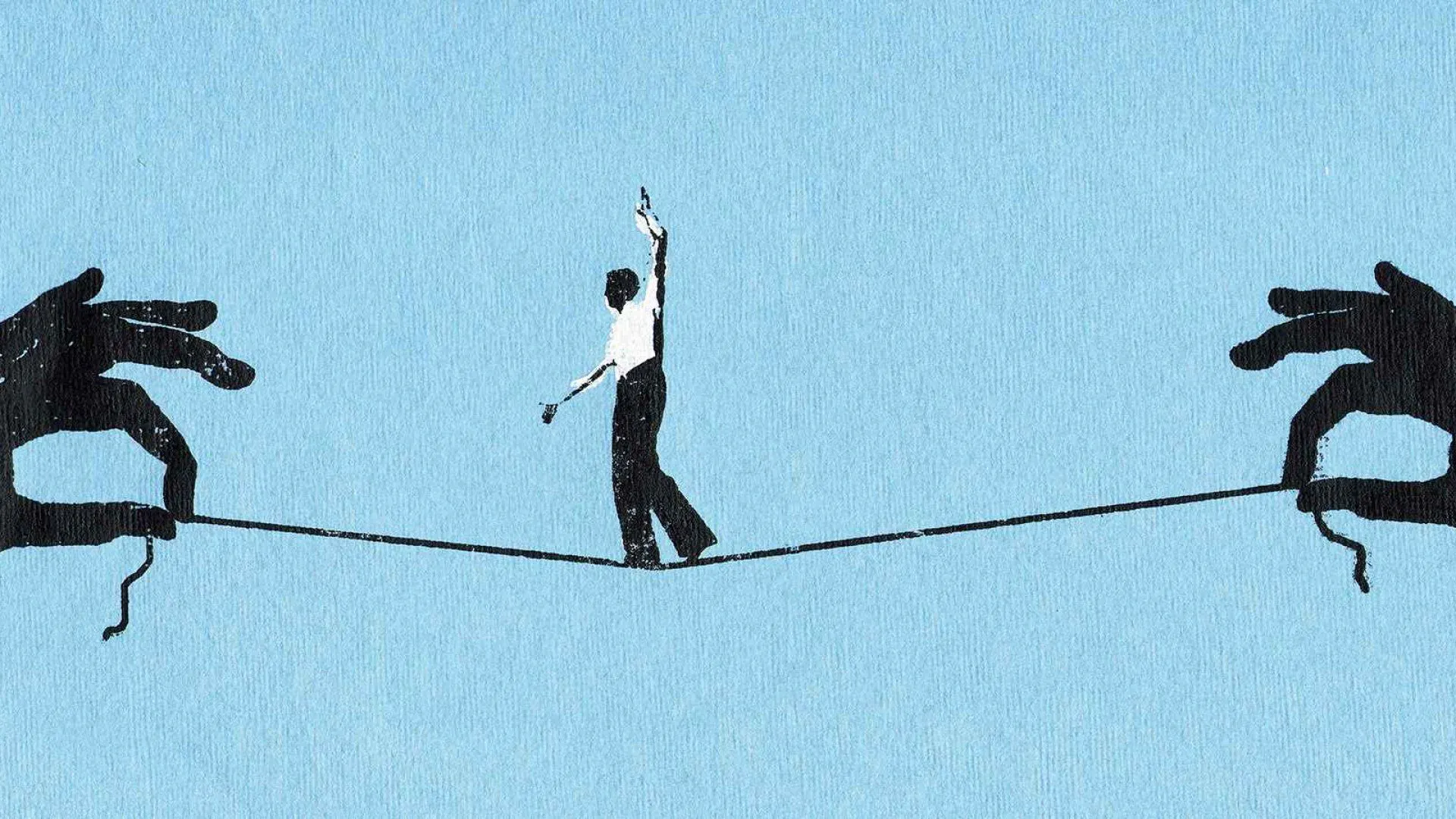

Navigating the Complexities of International Investing: Risks and Opportunities

Investing internationally can be a complex and difficult endeavor for investors. While there are numerous growth and diversification opportunities, there are also a number of risks to consider. In this article, we will discuss some of the complexities of international investing and offer strategies for overcoming these obstacles.

Different markets

The fact that different countries have diverse economic, political, and social environments is one of the primary complexities of international investing. This can make it challenging for investors to comprehend the risks and opportunities in a given market. Emerging markets, such as China, may offer high growth potential, but also carry a high degree of economic and political uncertainty. A developed market, such as the United States, may offer greater stability, but also less growth potential.

Different countries have different regulations, laws, and accounting standards, which adds to the complexity. This can make it difficult for international investors to compare companies and industries. For instance, accounting practices in China may be less transparent than in the United States, making it more difficult for investors to evaluate the financial health of a company.

Risks

Currency risk is another significant international investing complication. Currency fluctuations can have a substantial impact on an investment's value. For instance, if an investor purchases shares denominated in a foreign currency and the value of that currency falls relative to the investor's home currency, the value of the investment will also fall.

When considering international investments, investors should conduct extensive research and due diligence to navigate these complexities. This includes researching the country's or region's economic, political, and social environment, as well as specific companies and industries. Additionally, it is essential to be aware of any regulations, laws, and accounting standards that may differ from the investor's home country.

Diversification is key

Diversification across countries and regions is another method for mitigating risk. This can help mitigate the impact of economic or political conditions in any one country or region on the overall portfolio. Moreover, investors can employ currency hedging strategies to mitigate the effects of currency fluctuations on their investments.

Investing in funds that focus on international markets is one way to reduce the risk of investing in international markets. These funds are managed by seasoned fund managers with expertise in identifying and investing in multinational corporations. This can offer investors diversification, professional management, and a reduction in the time and resources required to research individual stocks.

Investing in emerging markets can also be a good way to gain exposure to high growth potential, but investors must be aware of the inherent risks. Frequently, emerging markets have less developed financial markets and less transparent accounting standards, making it difficult for investors to evaluate risks and opportunities. To mitigate risk, it is essential to conduct exhaustive research and due diligence and to diversify across countries and industries.

Another important consideration when investing internationally is the political and social environment of the country or region in question. For example, a country with a stable political environment and a positive outlook on foreign investment is likely to be a more attractive destination for international investors than a country with a history of political instability or a negative attitude towards foreign investment.

Additionally, investors should also be aware of the cultural and language barriers that may exist when investing internationally. This can make it difficult to communicate with local partners, understand local customs and regulations, and even to navigate the local business environment.

Furthermore, it is important to consider the level of economic development of a country when investing internationally. Developed markets such as the United States, Japan and Western Europe offer more stable and predictable investment environments, with well-established legal and regulatory frameworks. However, they may also offer lower growth potential than emerging markets. On the other hand, emerging markets such as China, Brasil, and Brazil offer higher growth potential but also come with higher levels of economic and political uncertainty.

Investors should also be aware of the different accounting standards used in different countries. Generally accepted accounting principles (GAAP) are used in the United States, while the International Financial Reporting Standards (IFRS) are used in many other countries. This can create a challenge for investors trying to compare financial statements across different countries and make informed investment decisions.

Finally, it is important to note that investing in international markets also means being subject to different tax laws and regulations. Investors should be aware of the tax implications of their international investments, and consider working with a tax advisor or professional to minimize their tax liability.

Conclusion

In conclusion, international investing can be a complex and difficult endeavor for investors, but it also offers numerous growth and diversification opportunities. By conducting extensive research and due diligence, diversifying across countries and regions, and employing currency hedging strategies, investors can successfully navigate the complexities of international investing and increase their chances of success.

In summary, investing in international markets can be a great way to diversify and potentially increase the overall return on investment. However, it is important to be aware of the complexities and risks that come with international investing.

By conducting thorough research and due diligence, diversifying across countries and regions, and utilizing currency hedging strategies, investors can navigate the complexities of international investing and maximize their chances of success. It is also important to be aware of the cultural and language barriers that may exist when investing internationally, the level of economic development of a country, and the different accounting standards used in different countries. Finally, investors should be aware of the tax implications of their international investments.

MA Titan'S RISK BASED INVESTMENT SOLUTION

MA Titan provides clients with a comprehensive AI-based trading solution. Customers who invest in the MA Titan AMC can have all AI-based trades from MA Titan executed automatically on their behalf.

Our MA Titan Algorithms, which are powered by machine learning, can quickly adapt to changing market conditions and identify potential risks, allowing our clients to reach their investment objectives despite volatile financial markets.

At MA Titan, we have expertise in economics, behavioral finance, and data, as well as a specialty in utilizing technology, including AI trading, to comprehend the market-driving factors and make intelligent investment decisions.